Rate Navy Federal Credit Union: A Comprehensive Guide To America's Largest Credit Union

Navy Federal Credit Union (NFCU) is a financial institution that consistently ranks among the top credit unions in the United States. With over 10 million members and assets exceeding $130 billion, it offers a wide range of financial products and services tailored to meet the needs of its members. Whether you're considering opening an account or simply exploring your options, understanding what NFCU has to offer can help you make informed decisions about your finances.

As one of the most reputable credit unions in the country, Navy Federal Credit Union stands out for its exceptional member benefits, competitive interest rates, and strong commitment to customer satisfaction. Founded in 1933, this institution has grown exponentially while maintaining its focus on providing value to its members.

This article delves into the various aspects of Navy Federal Credit Union, including its history, services, rates, and member experiences. By the end of this guide, you'll have a comprehensive understanding of why so many people rate Navy Federal Credit Union highly and whether it might be the right choice for your financial needs.

Table of Contents

- History of Navy Federal Credit Union

- Membership Eligibility

- Financial Services Offered

- Rate Navy Federal Credit Union: Interest Rates and Fees

- Benefits of Being a Member

- Reputation and Member Reviews

- Navy Federal Credit Union vs. Banks

- Security Measures and Fraud Protection

- Navy Federal Mobile App Experience

- Future Outlook for Navy Federal Credit Union

History of Navy Federal Credit Union

Established in 1933 during the Great Depression, Navy Federal Credit Union began as a small organization serving just seven members of the United States Naval Support Force in Washington, D.C. Today, it has grown into the largest credit union in the world by asset size. Its mission remains rooted in providing affordable financial services to military personnel, veterans, and their families.

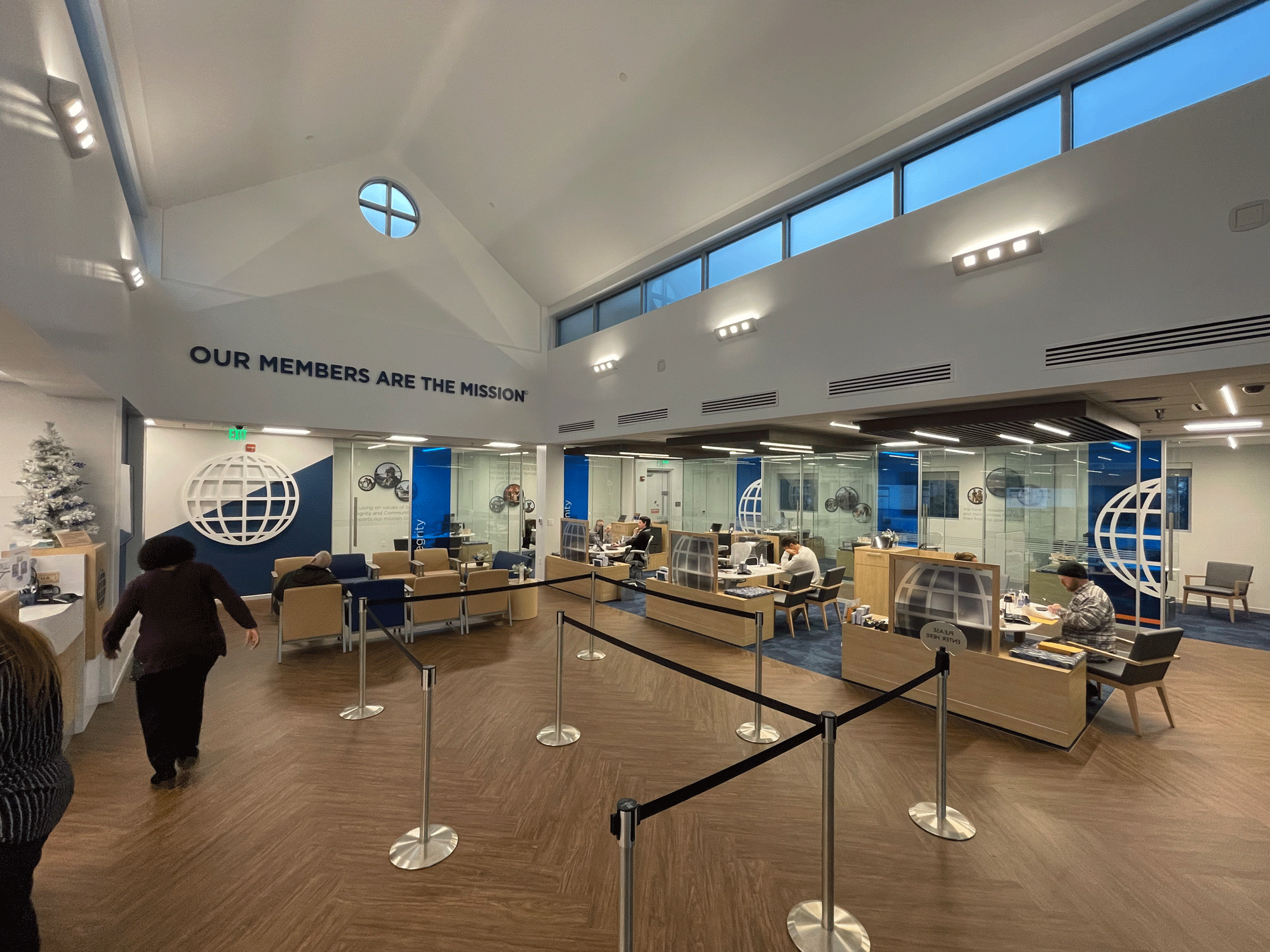

The credit union's expansion over the decades reflects its dedication to meeting the evolving needs of its members. From introducing new banking technologies to expanding its branch network, Navy Federal continues to innovate while preserving its core values of service and integrity.

According to a report by the National Credit Union Administration (NCUA), Navy Federal Credit Union consistently ranks among the top performers in terms of asset growth and member satisfaction. This strong track record contributes significantly to its reputation as a trusted financial institution.

Membership Eligibility

Who Can Join Navy Federal Credit Union?

One of the most common questions about Navy Federal Credit Union is regarding membership eligibility. While primarily serving military personnel, the credit union extends its membership to:

- Active duty, reserve, and retired members of the U.S. Armed Forces

- Department of Defense (DoD) civilian employees

- Family members of eligible individuals

- Members of select organizations such as the American Legion and Veterans of Foreign Wars (VFW)

Additionally, individuals who live, work, worship, or attend school in specific counties across the United States may also qualify for membership through Navy Federal's community charter.

Financial Services Offered

Savings Accounts

Navy Federal Credit Union offers a variety of savings accounts designed to help members grow their wealth. These include:

- Regular Savings Account

- Money Market Accounts

- Certificates of Deposit (CDs)

Each account type comes with competitive interest rates and no monthly maintenance fees, making them attractive options for savers of all levels.

Loans

Loans are another key area where Navy Federal excels. Members can choose from a wide range of loan products, including:

- Personal Loans

- Auto Loans

- Mortgage Loans

- Student Loans

These loans often feature low interest rates and flexible repayment terms, helping members achieve their financial goals more effectively.

Rate Navy Federal Credit Union: Interest Rates and Fees

When evaluating a financial institution, interest rates and fees play a crucial role in determining its value proposition. Navy Federal Credit Union consistently earns high marks in these areas due to its commitment to offering competitive rates and minimal fees.

For example, Navy Federal's savings account interest rates often exceed industry averages, while its loan rates remain lower than those charged by traditional banks. Furthermore, the credit union eliminates many common banking fees, such as account maintenance fees and ATM withdrawal fees within its network.

Data from the Federal Reserve indicates that credit unions like Navy Federal typically offer better rates than commercial banks, reinforcing their appeal to consumers seeking affordable financial services.

Benefits of Being a Member

Financial Education Resources

Navy Federal Credit Union goes beyond traditional banking services by providing extensive financial education resources to its members. These resources include webinars, articles, and tools designed to enhance financial literacy and empower members to make smarter financial decisions.

24/7 Customer Support

Members enjoy round-the-clock access to customer support through multiple channels, including phone, email, and live chat. This level of accessibility ensures that members receive timely assistance whenever they need it.

Reputation and Member Reviews

The reputation of Navy Federal Credit Union is built on decades of delivering exceptional service to its members. Numerous independent reviews and surveys highlight the credit union's strengths in areas such as customer service, product offerings, and overall member satisfaction.

For instance, J.D. Power consistently ranks Navy Federal highly in its annual credit union satisfaction study, citing factors such as ease of use, variety of products, and cost as key contributors to its positive ratings.

Navy Federal Credit Union vs. Banks

Comparing Navy Federal Credit Union to traditional banks reveals several advantages that set it apart. Unlike banks, which prioritize shareholder profits, credit unions operate as not-for-profit organizations focused on benefiting their members. This structure enables Navy Federal to offer better rates, lower fees, and more personalized service.

Moreover, Navy Federal's emphasis on member education and community involvement aligns with its mission to promote financial well-being among its members.

Security Measures and Fraud Protection

Security is a top priority at Navy Federal Credit Union. The institution employs advanced encryption technologies and multi-factor authentication to protect member accounts from unauthorized access. Additionally, it offers comprehensive fraud protection services, including fraud alerts and identity theft assistance.

According to the Federal Trade Commission (FTC), credit unions like Navy Federal are at the forefront of implementing cutting-edge security measures to safeguard consumer data.

Navy Federal Mobile App Experience

The Navy Federal Mobile App provides members with convenient access to their accounts anytime, anywhere. Key features include:

- Account balance and transaction history

- Bill payment and fund transfers

- Mobile check deposit

- Location services for nearby branches and ATMs

Users consistently rate the app highly for its user-friendly interface and reliable performance.

Future Outlook for Navy Federal Credit Union

Looking ahead, Navy Federal Credit Union continues to invest in innovation and expansion to better serve its growing membership base. Plans include enhancing digital banking capabilities, expanding physical branch locations, and introducing new financial products tailored to meet emerging member needs.

As the financial landscape evolves, Navy Federal remains committed to its mission of providing exceptional value and service to its members.

Kesimpulan

In conclusion, Navy Federal Credit Union stands out as a premier financial institution offering competitive rates, excellent customer service, and a wide array of financial products. By understanding what sets Navy Federal apart from traditional banks and other credit unions, you can determine whether it aligns with your financial goals.

We encourage you to share your thoughts on this article or ask any questions in the comments section below. Additionally, feel free to explore other informative articles on our website to further enhance your financial knowledge. Together, let's build a brighter financial future!